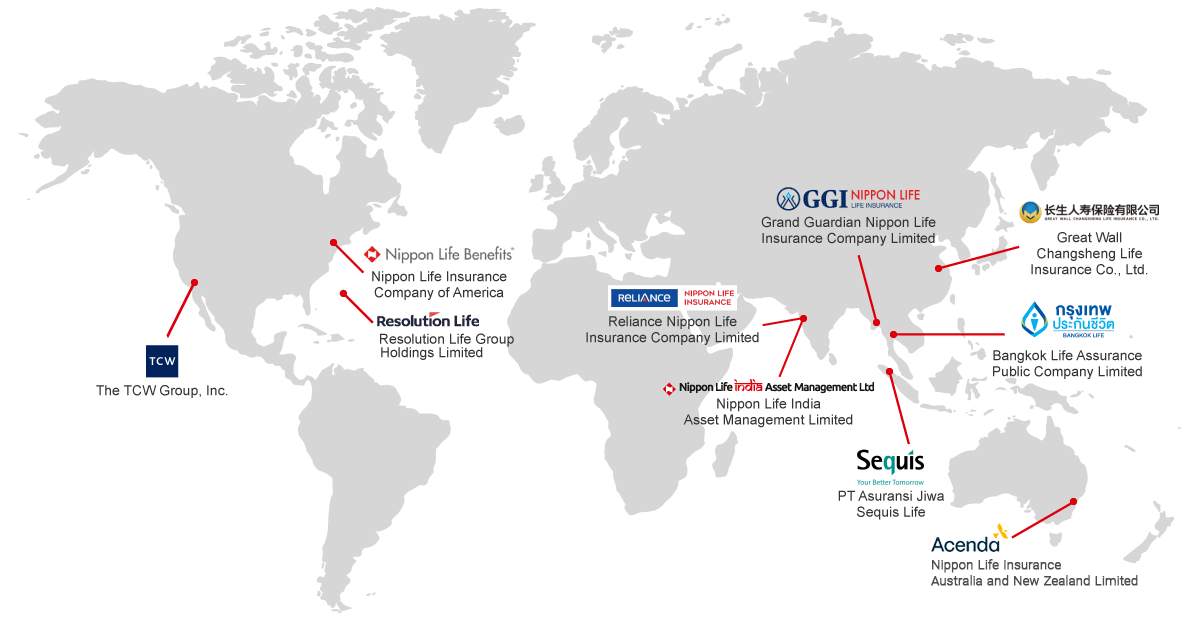

Insurance Business

U.S.

Nippon Life Insurance Company of America

Established in 1991 as our first overseas primary insurance company, Nippon Life Insurance Company of America provides products and services, mainly group medical insurance, in New York, Los Angeles, Chicago, and other cities under its motto of "Nissay even in America." In particular, the company has been highly evaluated by Japanese and South Korean companies that operate in the US by offering customer service in Japanese and Korean.

It will continue working on initiatives aimed at strengthening product-specic business strategies and enhancing customer satisfaction.

Company Information (As of Mar. 31, 2025)

| Country | The United States |

|---|---|

| Established | 1991 |

| Main distribution channel | Brokers |

| Premium revenue(FY2024)* | ¥51.5 billion |

| Number of employees | 88 |

| Investment ratio | 96.96% |

| Products | Group Medical Insurance and others |

-

*

Jan. 2024 to Dec.2024

Australia and New Zealand

Acenda Group

Acenda Group provides insurance products and services for individuals and groups throughout Australia and New Zealand, mainly through financial advisers and other distribution channels. In 2016, Nippon Life acquired the life insurance business of National Australia Bank and established Nippon Life Insurance Australia and New Zealand (formerly MLC) as a subsidiary.

In 2025, through corporate restructuring resulting from the acquisition of Resolution Life as a wholly owned subsidiary, the Nippon Life Australia and New Zealand NOHC came to own Nippon Life Insurance Australia and New Zealand, Resolution Life Australasia, and Asteron Life, thereby establishing the Acenda Group. The Group aims to achieve stable growth and expansion of earnings, and continues to share initiatives and collaborate with Nippon Life across a wide range of areas.

Group Information (As of Oct. 31, 2025)

| Country | Australia, New Zealand |

|---|---|

| Established | 2025 |

| Main distribution channel | Financial advisors, etc. |

| Premium revenue(FY2024)* | ¥181.1 billion |

| Number of employees** | 1,409 |

| Investment ratio*** | 100.00% |

| Products | Term Life Insurance, Income Protection Insurance, Critical Illness Insurance |

-

*

Jan. 2024 to Dec. 2024, Figures for standalone Nippon Life Insurance Australia and New Zealand Limited

-

**

Figures for standalone Nippon Life Insurance Australia and New Zealand Limited

-

***

Includes indirect investments

Bermuda

Resolution Life Group Holdings Limited

Resolution Life is a global life insurance group with subsidiaries in Bermuda, the United Kingdom, and the United States, and engages in the acquisition and management of in-force policy blocks and reinsurance.It is a pioneer in the in-force policy acquisitions business while also providing policyholders with high-quality maintenance and payment services through the use of digital technology and AI.

Nippon Life began investing in the company in 2019, made it an affiliate in 2023, and made it a wholly owned subsidiary in 2025.Nippon Life is working to create synergies by leveraging Resolution Life’s reinsurance capabilities and its advanced expertise in AI and digital technologies.

Company Information (As of Oct 31,2025)

| Country | Bermuda |

|---|---|

| Established | 2017 |

| Premium revenue(FY2024)* | ¥240.9 billion |

| Number of employees** | 612 |

| Investment ratio | 100% |

-

*

Jan. 2024 to Dec. 2024

-

**

As of July,2025

India

IndusInd Nippon Life Insurance Company Limited

IndusInd Nippon Life Insurance has an extensive network of sales offices throughout India and mainly offers products and services to individuals and groups through agents. Since investing in the company in 2011, Nippon Life has shared its expertise, including the launch of distribution channels based on Nippon Life’s sales representatives model. As of March 2025, an investment holding company chaired by Ashok P. Hinduja, along with others became the shareholders. Under this new joint venture structure, we aim for further growth by leveraging the strengths of both shareholders.

Company Information (As of Mar. 31, 2025)

| Country | India |

|---|---|

| Established | 2001 |

| Main distribution channel | Agents and sales representatives |

| Premium revenue(FY2024)* | ¥103.3 billion |

| Number of employees | 11,050 |

| Investment ratio | 49.00% |

| Products | Endowment Insurance and other savings products |

-

*

Apr. 2024 to Mar. 2025

Myanmar

Grand Guardian Nippon Life Insurance Company Limited

Grand Guardian Nippon Life mainly offers endowment and other insurance products through bancassurance and agents.

Since establishing the company as a joint venture with one of the leading conglomerates in Myanmar in 2019, Nippon Life has been seconding senior management personnel to the company as part of its efforts to build a management foundation. These efforts include developing new products and establishing sales channels based on Nippon Life's sales representatives model. We will continue widely popularizing life insurance in Myanmar as a way of contributing to the initial development of the country's life insurance market.

Company Information (As of Mar. 31, 2025)

| Country | Myanmar |

|---|---|

| Established | 2019 |

| Main distribution channel | Bancassurance, agents, sales representatives, etc. |

| Premium revenue(FY2024)* | ¥1.88 billion |

| Number of employees | 632 |

| Investment ratio | 35.00% |

| Products | Endowment Insurance and other savings products, Agricultural and Travel Insurance, and others |

-

*

Apr. 2024 to Mar. 2025

China

Great Wall Changsheng Life Insurance Co., Ltd.

Great Wall Changsheng Life Insurance mainly provides long-term and protection products through agents in Shanghai, Zhejiang, Jiangsu, and other parts of China.

Since 2003, when the company was established as the first joint venture between a Japanese life insurance company and a local firm in China, Nippon Life has shared knowledge and is working to advance Great Wall Changsheng's business and risk management in partnership with a major Chinese financial asset company.

Going forward, the company will continue to promote collaborative efforts in areas such as unique product development and services for Japanese companies based in China.

Company Information (As of Mar. 31, 2025)

| Country | China |

|---|---|

| Established | 2003 |

| Main distribution channel | Agents |

| Premium revenue(FY2024)* | ¥60 billion |

| Number of employees | 379 |

| Investment ratio | 30.00% |

| Products | whole life insurance |

-

*

Jan. 2024 to Dec. 2024

Thailand

Bangkok Life Assurance Public Company Limited

Bangkok Life Assurance is a listed company with operations throughout Thailand, including Bangkok, which provides insurance and related services in line with diverse customer needs through its major shareholder and the largest bank in Thailand, Bangkok Bank, as well as agents.

Nippon Life invested in the company in 1997 and made it an affiliate in 2004.

The company will continue to further expand sales in the bancassurance channel

by strengthening its relationship with Bangkok Bank, as well as promoting the expansion of its agent channel and strengthening sales through the knowledge and other support offered by Nippon Life.

Company Information (As of Mar. 31, 2025)

| Country | Thailand |

|---|---|

| Established | 1951 |

| Main distribution channel | Bancassurance and agents |

| Premium revenue(FY2024)* | ¥145.3 billion |

| Number of employees | 1,137 |

| Investment ratio | 24.21% |

| Products | Endowment insurance and whole life insurance |

-

*

Jan. 2024 to Dec. 2024

Indonesia

PT Asuransi Jiwa Sequis Life

Sequis Life provides insurance products and services throughout Indonesia, including Jakarta, through high-quality agents.

Nippon Life invested in the company and made it an affiliate in 2014. Together with one of Indonesia's leading conglomerates, we are promoting the sophistication of asset management utilizing Nippon Life's expertise and network.

We are working to train agents and diversify its distribution channels to further meet asset formation and coverage protection needs.

Company Information (As of Mar. 31, 2025)

| Country | Indonesia |

|---|---|

| Established | 1984 |

| Main distribution channel | Agents |

| Premium revenue(FY2024)* | ¥27.4 billion |

| Number of employees | 745 |

| Investment ratio** | 20.00% |

| Products | Whole Life Insurance, Endowment Insurance, Unit-Linked Products |

-

*

Jan. 2024 to Dec. 2024

-

**

Includes indirect investments

Asset Management Business

India

Nippon Life India Asset Management Limited

Nippon Life India Asset Management is a fast-growing asset management firm and subsidiary with an expansive investment product lineup ranging from stocks to bonds and ETFs in India's asset management industry, which continues to experience high growth. By supplying products to Nissay Asset Management, the company also provides Japanese customers with opportunities to invest in India.

Company Information (As of Mar. 31, 2025)

| Country | India |

|---|---|

| Established | 1995 |

| Number of employees | 1,105 |

| Assets under management* | ¥9.7 trillion (5.5 trillion INR) |

| Investment ratio | 72.32% |

-

*

Mutual fund only

U.S.

The TCW Group, Inc.

The TCW Group is a US-based asset management firm with expertise in managing US bonds. Along with managing one of the largest mutual funds in the US and supplying investment products to the world's largest pension funds, institutional investors, and others, the company also provides Japanese customers with global, primarily American, investment opportunities.

Company Information (As of Mar. 31, 2025)

| Country | The United States |

|---|---|

| Established | 1971 |

| Number of employees | 649 |

| Assets under management* | ¥28.8 trillion (192.8 billion USD) |

| Investment ratio | 27.09% |

Find out more

Insurance Business

TAIJU LIFE INSURANCE COMPANY LIMITED

TAIJU LIFE INSURANCE COMPANY LIMITED is a life insurance

company originally founded as Mitsui Life Insurance Co., Ltd. in

March 1927.

The company underwent management integration

with Nippon Life in December 2015, and changed its name to

TAIJU LIFE INSURANCE COMPANY LIMITED in April 2019.

TAIJU LIFE will continue to meet diversifying customer needs as part of

a unified Group in several areas, including products and services.

Company Information (As of Mar.31,2025)

| Established | 1947* |

|---|---|

| Number of Employees | 10,878 |

| Revenues from Insurance Premiums | ¥824.8billion |

| Main Distribution Channel | Sales Representatives |

| Main Products and Services | Insurance with Customizable Coverage |

| Investment Ratio | 85% |

-

*

Established in 1927 (as Mitsui Life Insurance Co., Ltd.)

Nippon Wealth Life Insurance Company Limited

Since the management integration with Nippon Life in

May 2018, Nippon Wealth has made progress on initiatives

toward creating synergy between both companies with

the aim of upgrading and expanding its lineup of Group

products and strengthening its system of sales and support

for partner financial institutions.

Both companies will continue working together to expand their network of partner financial institutions and the products they carry.

Company Information (As of Mar.31,2025)

| Established | 1947* |

|---|---|

| Number of Employees | 579 |

| Revenues from Insurance Premiums | ¥1.8875trillion |

| Main Distribution Channel | Finance institution channel |

| Main Products and Services | Single payment whole life insurance |

| Investment Ratio | 100% |

-

*

Founded in 1907

HANASAKU LIFE INSURANCE Co., Ltd.

HANASAKU LIFE INSURANCE Co., Ltd. is a life insurance

company that started operations in April 2019 to respond

flexibly and quickly to diversifying customer needs.

The company flexibly provides products through the agency

channel as well as direct channels (mail-order and online),

and works to improve the convenience of procedures through

the use of digital technology.

Company Information (As of Mar.31,2025)

| Established | 2018 |

|---|---|

| Number of Employees | 410 |

| Revenues from Insurance Premiums | ¥69.0billion |

| Main Distribution Channel | Agencies/Direct (mail-order and online) |

| Main Products and Services | Medical insurace, etc |

| Investment Ratio | 100% |

Nissay Plus SSI Company Inc.

Nissay Plus SSI Company Inc. that started operations in

April 2022 in order to respond to diversifying coverage needs

against a background of lifestyle changes and the digital

environment becoming more widespread.

The company aims to provide products that can meet diverse customer needs

by collaborating with various partner companies to combine

partner company products and services with highly compatible

insurance products.

Company Information (As of Mar.31,2025)

| Established | 2021 |

|---|---|

| Number of Employees | 24 |

| Revenues from Insurance Premiums | ¥65million |

| Main Distribution Channel | Direct (online) |

| Main Products and Services | Small-amount,short-term insurance |

| Investment Ratio | 100% |

Asset Management

Nissay Asset Management Corporation

Nissay Asset Management is a 100% subsidiary asset

management company established in 1995 that brings

together the Group’s asset management capabilities.

The company leverages its expertise in insurance asset

management to supply a wide range of investment products

that meet the needs of pension funds, as well as individual

investors and other customers, for long-term, stable asset

building.

Company Information (As of Mar.31,2025)

| Established | 1995 |

|---|---|

| Number of Employees | 700 |

| Assets under Management | ¥41.2trillion |

| Investment Ratio | 100% |

Other Group Companies

Nissay Information Technology Co., Ltd

Nissay Information Technology was established in 1999 as a company that would be responsible for the IT strategy of the Nippon Life Group.

Along with undertaking system development and

other processes for new products from Nippon Life in

order to meet diversifying market needs and other needs,

the company is harnessing its vast experience in order

to provide high-quality IT services and consulting in the

social insurance market, such as insurance and mutual

aid, annuities, and healthcare.

Company Information (As of Mar.31,2025)

| Established | 1999 |

|---|---|

| Number of Employees | 2,533 |

| Sales | ¥89billion |

| Main Products and Services |

|

| Investment Ratio | 83.92% |